Today, NCB Financial Group Limited (NCBFG) remains resilient as we continue to navigate a historic period of global turmoil, which spared no organisation from the challenges of a lifetime.

Cognisant of the headwinds that remain, we continue undaunted – bolstered by our commitment to our purpose and to the stakeholders we serve. We celebrate the challenges and triumphs that have shaped the organisation throughout its history, with roots dating back 185 years. We salute the passion, dedication and sacrifice of each team member, customer, partner, and shareholder who has been part of the journey. After 185 years of empowering people, unlocking dreams and building communities, we stand unified, confident, and energised to do even more.

As we forge into a future that promises to be dynamic and uncertain, we remain steadfast in pursuit of our aspiration to become a world-class Caribbean financial ecosystem. Throughout our history, we have emerged stronger from crises by actively searching and capitalising on the inherent opportunities present in each crisis. We are committed to playing a pivotal role in the pursuit of economic growth and improved livelihoods for citizens of the region through the products and services we provide; our corporate philanthropy and citizenship; good corporate governance; and by serving as an example of achieving bold aspirations despite challenges and constraints. Facing the challenges of today is the only way to unlock the possibilities of tomorrow. Rest assured, that while the journey may require pivots and detours, our determination is fixed.

Today, NCB Financial Group Limited (NCBFG) remains resilient as we continue to navigate a historic period of global turmoil, which spared no organisation from the challenges of a lifetime.

Cognisant of the headwinds that remain, we continue undaunted – bolstered by our commitment to our purpose and to the stakeholders we serve. We celebrate the challenges and triumphs that have shaped the organisation throughout its history, with roots dating back 185 years. We salute the passion, dedication and sacrifice of each team member, customer, partner, and shareholder who has been part of the journey. After 185 years of empowering people, unlocking dreams and building communities, we stand unified, confident, and energised to do even more.

As we forge into a future that promises to be dynamic and uncertain, we remain steadfast in pursuit of our aspiration to become a world-class Caribbean financial ecosystem. Throughout our history, we have emerged stronger from crises by actively searching and capitalising on the inherent opportunities present in each crisis. We are committed to playing a pivotal role in the pursuit of economic growth and improved livelihoods for citizens of the region through the products and services we provide; our corporate philanthropy and citizenship; good corporate governance; and by serving as an example of achieving bold aspirations despite challenges and constraints. Facing the challenges of today is the only way to unlock the possibilities of tomorrow. Rest assured, that while the journey may require pivots and detours, our determination is fixed.

Clarien Group provides personal, commercial, and private banking services to clients primarily based in Bermuda.

It is one of the largest independent, privately-owned integrated financial services organisations in Bermuda, with an extensive portfolio of offerings. These include personal banking, business banking and payment services through Clarien Bank Limited; exclusive wealth management services through Clarien Investments Limited; and customised trust and fiduciary services through Clarien Trust Limited.

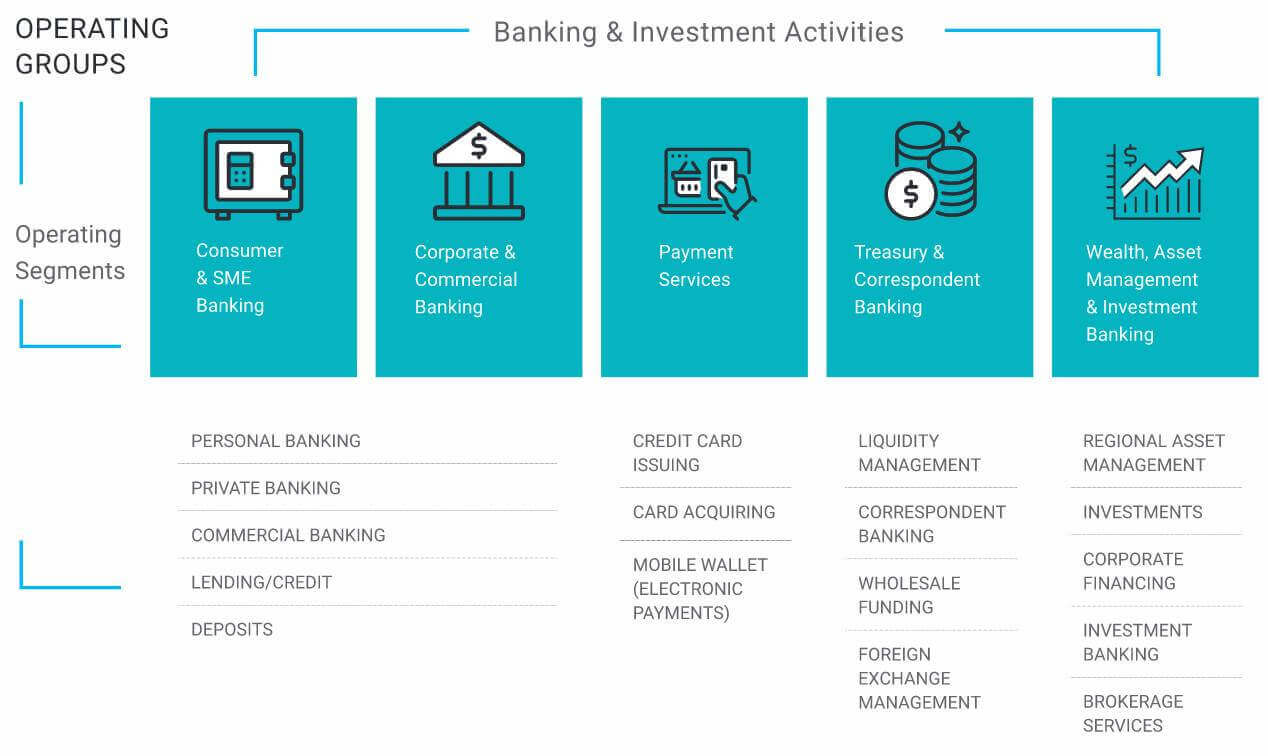

Guardian Holdings Limited is the parent company of the Guardian Group, an integrated financial services provider that focuses on life, health, property, and casualty insurance, as well as pensions and asset management.

The Group currently serves markets in 21 territories across the English- and Dutchspeaking Caribbean, including Aruba, Barbados, Bonaire, Curaçao, Jamaica, St. Maarten, and Trinidad and Tobago.

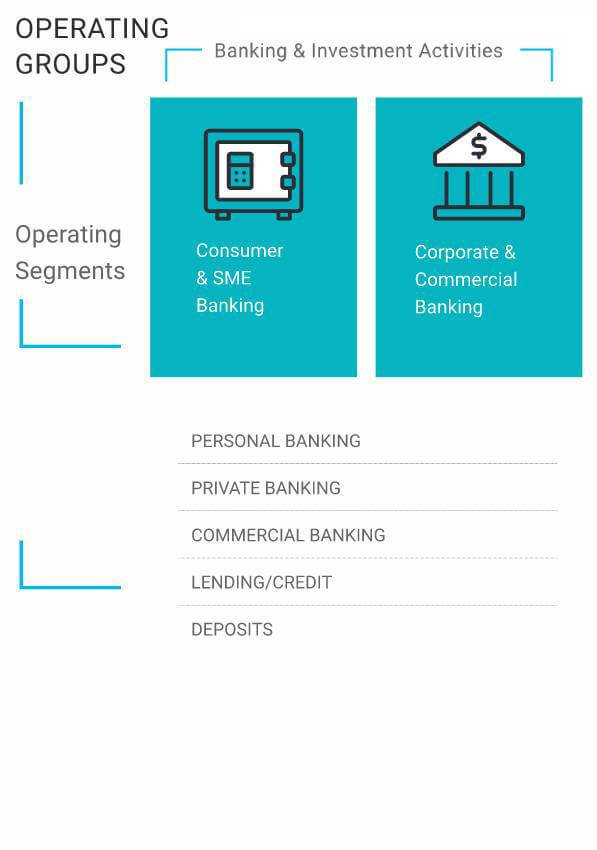

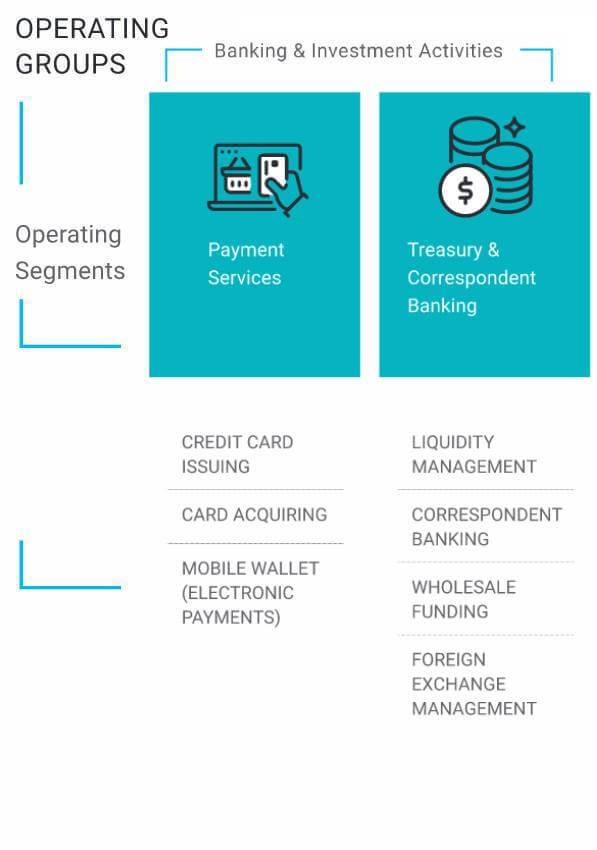

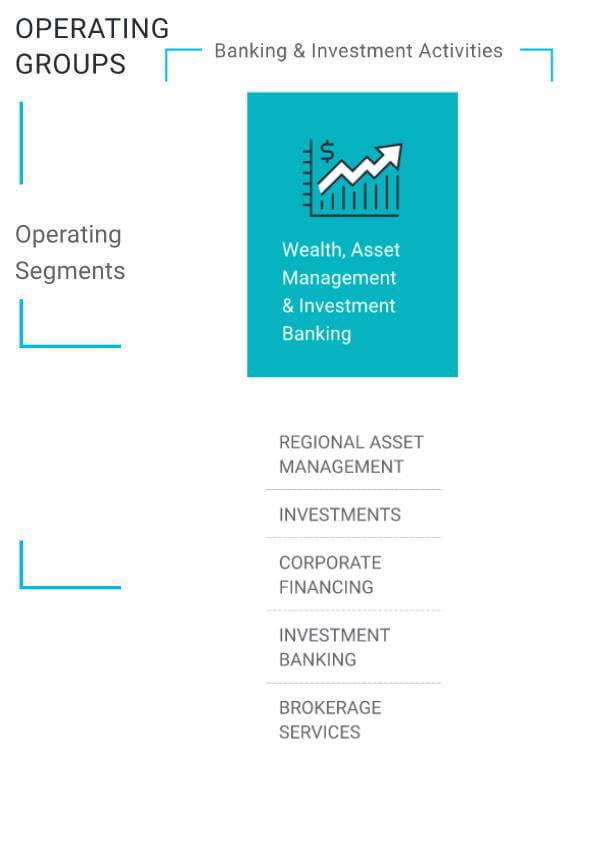

The NCB Entities provide an expansive range of products and services aimed at meeting all the personal and commercial banking, payment services, wealth, insurance, and asset management needs of customers primarily in Jamaica, the Cayman Islands, Barbados and Trinidad and Tobago.

The NCB Entities comprise National Commercial Bank Jamaica Limited (NCBJ), TFOB (2021) Limited (TFOB) and NCBJ’s subsidiaries - the main subsidiaries being NCB Capital Markets Limited, NCB Capital Markets (Barbados) Limited, NCB Insurance Agency and Fund Managers Limited, NCB (Cayman) Limited, and NCB Merchant Bank (Trinidad and Tobago) Limited.

NCBJ and its Jamaican subsidiaries have over 20 locations – including digital and full-service branches and six financial centres – and more than 300 ABMs and financial kiosks. TFOB is a fintech company providing digital financial services. TFOB introduced Lynk, a mobile wallet, in 2021, enabling customers to send and receive money from their mobile devices via peer-to-peer transfers.

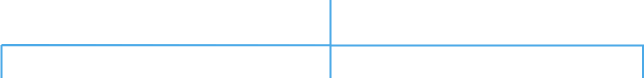

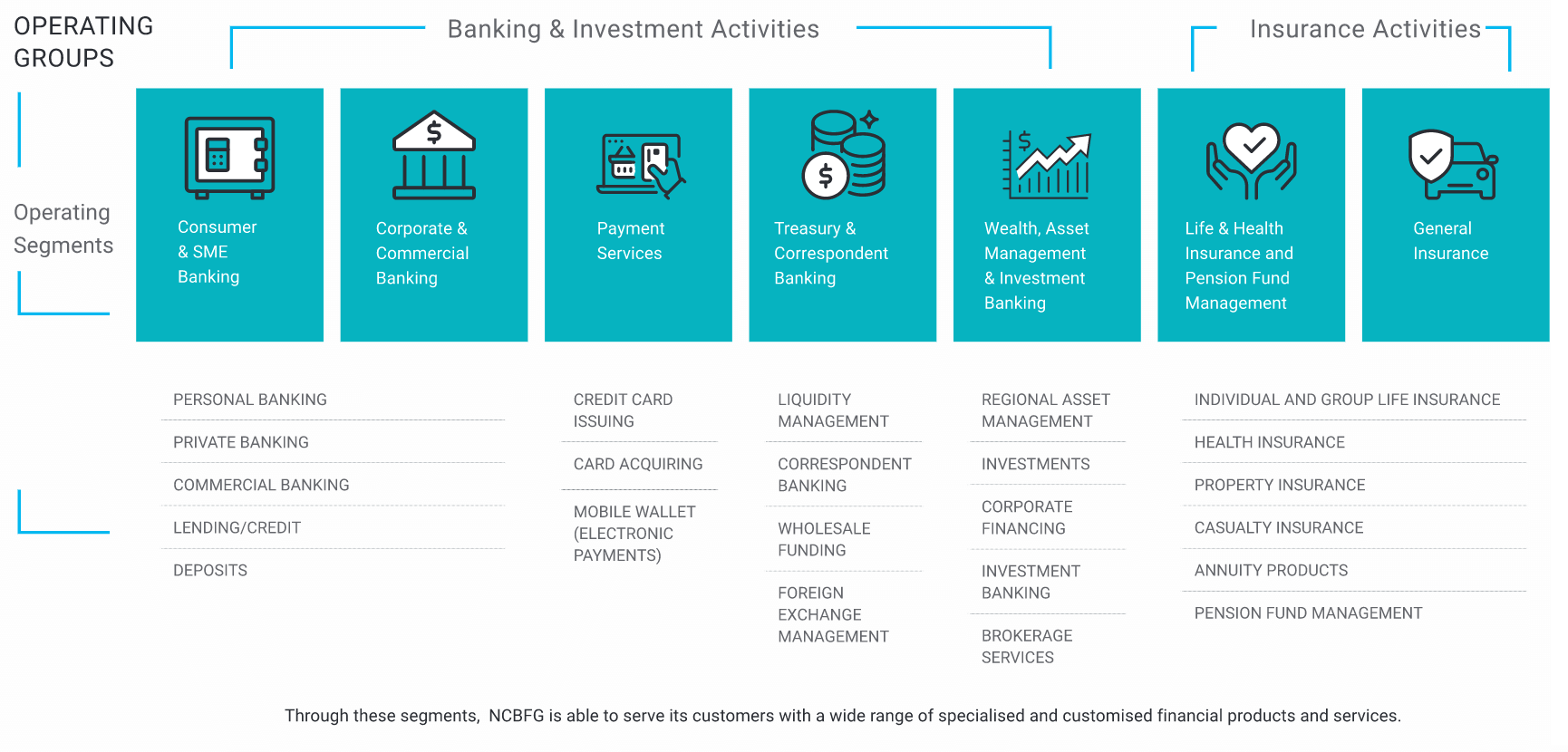

Through these segments, NCBFG is able to serve its customers with a wide range of specialised and customised financial products and services.

Empowering People

Unlocking Dreams

Building Communities

Treat others how we want to be treated.

Take accountability for all outcomes and embrace challenges as opportunities to win!

Delights all customers as he/she consistently anticipates and exceeds their expectations.

Collaborate and support others on the journey towards our aspiration.

Think creatively and pursue solutions that add value.

Speaks up, shows up courageously and pushes relentlessly towards our aspiration.

People can rely on us to show up with integrity and do what we say.

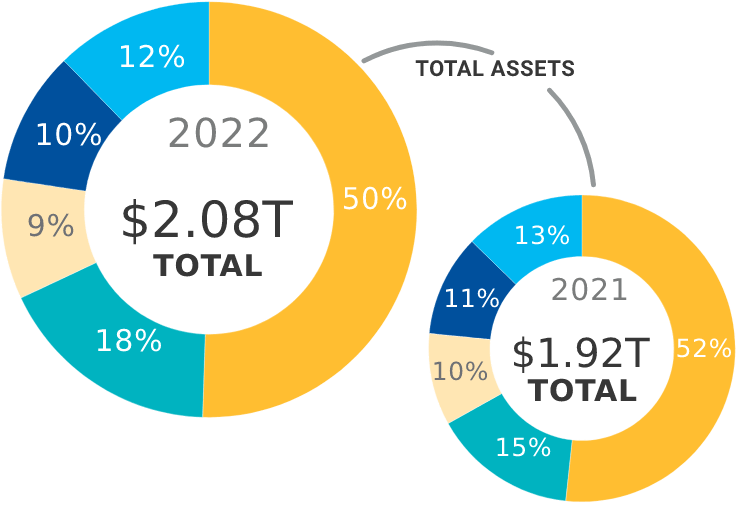

Expressed in Jamaican dollars unless otherwise indicated.

Jamaica

Trinidad & Tobago

Dutch Antilles

Bermuda

Other

Managing Director at

Campus Elite & Lynk Small

Business Customer

Sandre, the young Managing Director of the creative marketing and promotions firm Campus Elite is a graduate of the University of the West Indies (Mona) who now hires current students at the university as part of his workforce. His small business no only promotes Lynk, TFOB (2021) Limited's digital wallet but is a Link customer. Sandre pays his young team members - some of whom are unbanked, all of whom have smartphones - with Lynk and is impressed by how they use it, not just to send and receive money, but as a budget management tool.